vermont department of taxes homestead declaration

Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information presented here. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144.

Printing and scanning is no longer the best way to manage documents.

. Property owners whose dwellings meet the definition of a Vermont homestead must. Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI-144 Household Income with the. For more information on the Homestead Declaration and the Property Tax Adjustment Claim visit wwwtaxvermontgov or contact the Vermont Department of Taxes at.

The new myVTax guide released by the Vermont Department of Taxes How to File a Homestead Declaration or. 2 were Vermont residents all of calendar year 2021. 802 828-2865 133 State Street Montpelier VT 05633-1401 For.

Go digital and save time with signNow the best. Homestead Declarations must be filed annually. All groups and messages.

Handy tips for filling out Vermont homestead declaration online. Vermont tax accountant cpa. Domicile Statement Property Tax Homestead Declaration Domicile Statement Vermont Department of Taxes Phone.

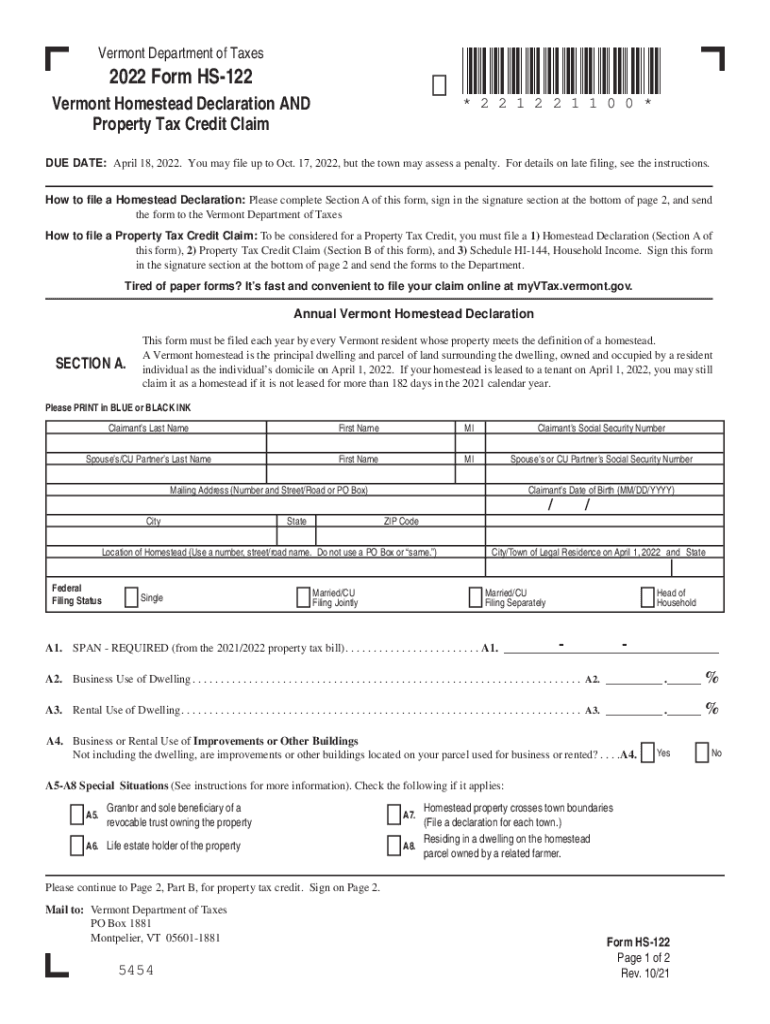

Download or print the 2021 Vermont Form HS-122 HI-144 Homestead Declaration AND Property Tax Adjustment Claim for FREE from the Vermont Department of Taxes. Mon 01242022 - 1200. If your property fulfills the criteria to be declared a homestead you can file a Vermont homestead declaration and property tax adjustment every year.

Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information presented here. 2021 Vermont Income Tax Return Booklet. January 28 2020.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter. Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim. This booklet includes forms and instructions for.

Homeowners eligible for a credit are those who 1 owned the property as a principal home on April 1. Those who are unable to meet the May 17 personal income tax filing deadline may file an application to extend to October 15 but taxpayers must still pay any tax owed by May.

Vermont Department Of Taxes Youtube

How To File And Pay Sales Tax In Vermont Taxvalet

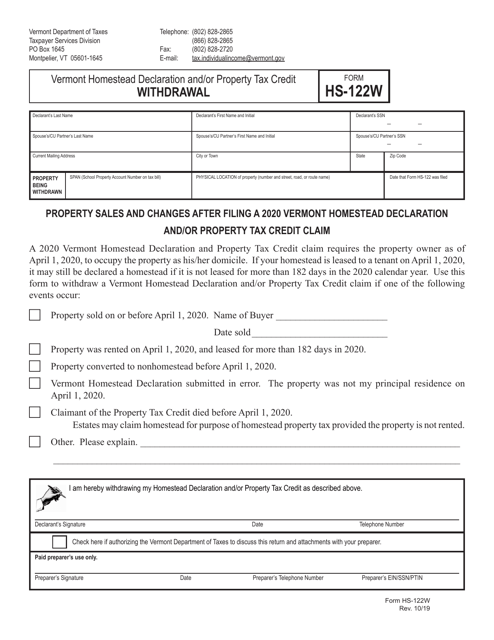

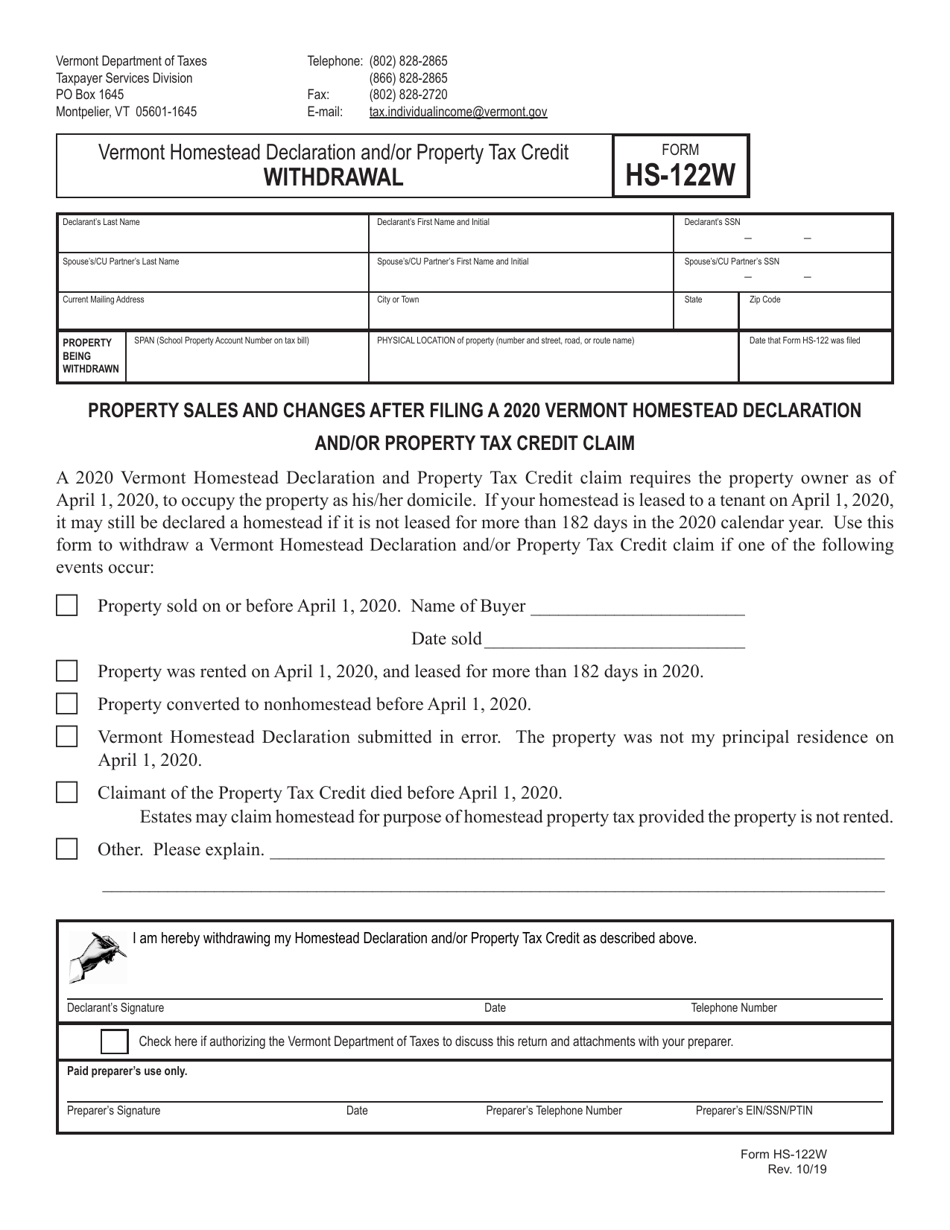

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Vermont Tax Forms And Instructions For 2021 Form In 111

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Department Of Taxes Youtube

Vt Form Hs 122 2022 Fill And Sign Printable Template Online Us Legal Forms

50 000 More Vermont Returns Expected By Wednesday Tax Deadline Vtdigger